Oil prices closed higher on Friday, February 17th, 2024, capping off a weekly gain fueled by ongoing geopolitical tensions in the Middle East. This rise comes despite lingering concerns about slowing global energy demand.

With a weekly gain of almost 3%, the price of U.S. crude reached its highest level since November 6. The worldwide benchmark reached its highest level since January 26 after rising 1.5% during the course of the week.

Market sentiment was primarily driven by concerns about potential disruptions to oil supplies from the Middle East. Recent escalations in regional conflicts, including ongoing hostilities between Israel and Lebanon, and missile attacks targeting key Saudi oil facilities, raise uncertainty about the stability of oil production in the region. This uncertainty pushed Brent crude futures up 0.74% to settle at $83.47 per barrel, while the US benchmark, West Texas Intermediate (WTI), rose 1.49% to reach $79.19 per barrel.

In Israel’s conflict with Islamist group Hamas, the main operational hospital in Gaza was under siege as airplanes attacked Rafah, the final Palestinian enclave haven.

After a missile fired from Yemen damaged a vessel carrying crude oil headed for India, threats remained in the Red Sea.

However, the oil price rally didn’t erase concerns about softening global energy demand. The International Energy Agency (IEA) recently published a report forecasting slower oil demand growth in 2024 compared to 2023, citing economic headwinds and increasing adoption of renewable energy sources. This dip in demand expectations could pose a long-term challenge to sustained price increases.

Bob Yawger, managing director and energy derivatives strategist at Mizuho America, described speculative traders as “this is geopolitics with flashing lights, it points right to specs taking advantage of the situation.” “They’re rolling the dice expecting something will happen.”

Some analysts downplayed the immediate impact of geopolitical tensions on oil prices, suggesting that current disruptions haven’t significantly impacted actual oil flows. They argue that the market remains well-supplied, and the price increase might be a knee-jerk reaction rather than a reflection of fundamental supply concerns.

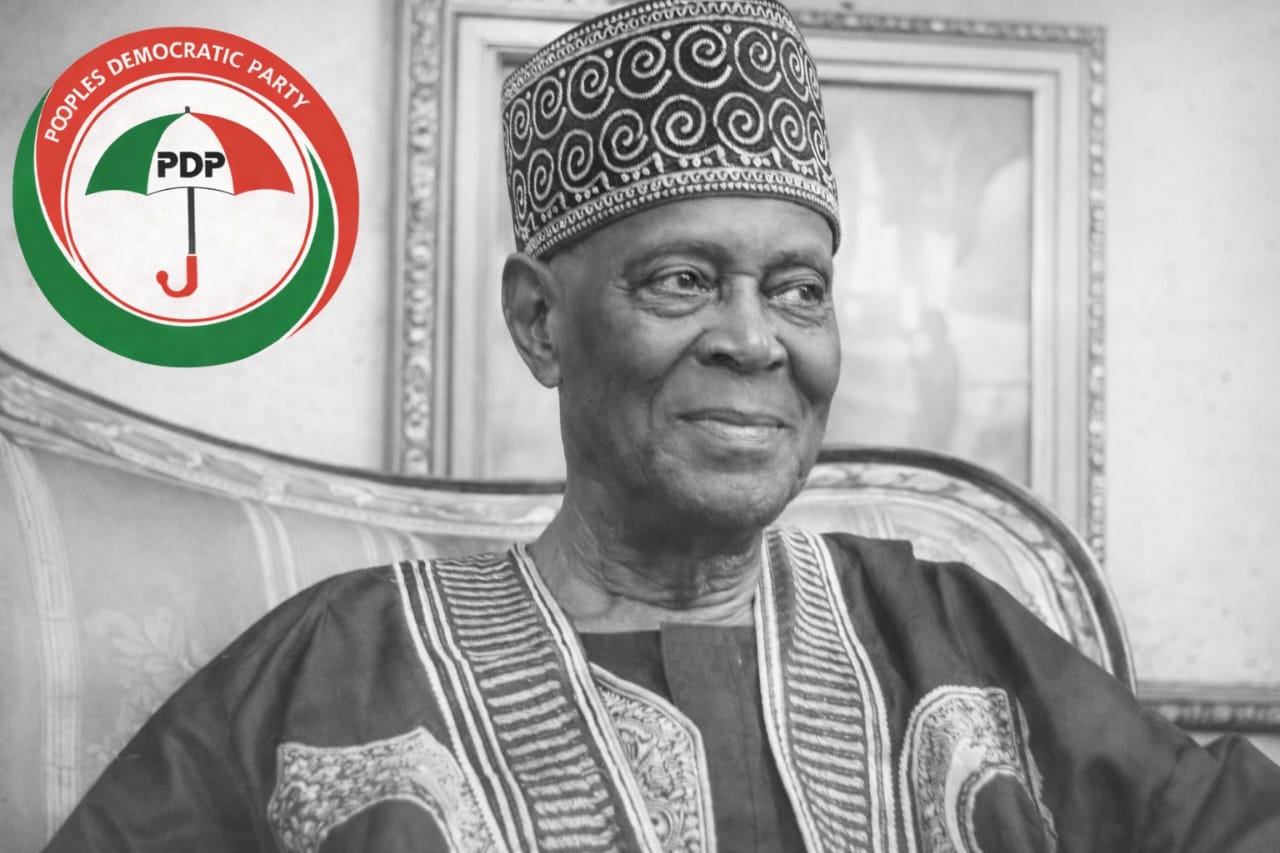

[{"id":15009,"link":"https:\/\/www.kwaralefro.com\/2026\/01\/kwara-pdp-mourns-ojora-patriarch-otunba-adekunle-ojora-ofr\/","name":"kwara-pdp-mourns-ojora-patriarch-otunba-adekunle-ojora-ofr","thumbnail":{"url":"https:\/\/www.kwaralefro.com\/wp-content\/uploads\/2026\/01\/IMG-20260128-WA0007.jpg","alt":""},"title":"Kwara PDP Mourns Ojora Patriarch, Otunba Adekunle Ojora (OFR)","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Jan 28, 2026","dateGMT":"2026-01-28 19:54:09","modifiedDate":"2026-01-28 19:55:28","modifiedDateGMT":"2026-01-28 19:55:28","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/kwara-news\/\" rel=\"category tag\">Kwara News<\/a>, <a href=\"https:\/\/www.kwaralefro.com\/category\/politics\/\" rel=\"category tag\">Politics<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/kwara-news\/\" rel=\"category tag\">Kwara News<\/a> <a href=\"https:\/\/www.kwaralefro.com\/category\/politics\/\" rel=\"category tag\">Politics<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":1,"sec":50},"status":"publish","excerpt":""},{"id":15006,"link":"https:\/\/www.kwaralefro.com\/2026\/01\/video-saraki-receives-football-legend-kanu-nwankwo-hails-his-impact-on-nigerian-football-2\/","name":"video-saraki-receives-football-legend-kanu-nwankwo-hails-his-impact-on-nigerian-football-2","thumbnail":{"url":"https:\/\/www.kwaralefro.com\/wp-content\/uploads\/2026\/01\/IMG-20260123-WA00001.jpg","alt":""},"title":"Video: Saraki Receives Football Legend Kanu Nwankwo, Hails His Impact on Nigerian Football","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Jan 23, 2026","dateGMT":"2026-01-23 02:02:15","modifiedDate":"2026-01-23 02:05:32","modifiedDateGMT":"2026-01-23 02:05:32","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/sports\/\" rel=\"category tag\">Sports<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/sports\/\" rel=\"category tag\">Sports<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":1,"sec":9},"status":"publish","excerpt":""},{"id":15004,"link":"https:\/\/www.kwaralefro.com\/2026\/01\/video-saraki-receives-football-legend-kanu-nwankwo-hails-his-impact-on-nigerian-football\/","name":"video-saraki-receives-football-legend-kanu-nwankwo-hails-his-impact-on-nigerian-football","thumbnail":{"url":"https:\/\/www.kwaralefro.com\/wp-content\/uploads\/2026\/01\/IMG-20260123-WA00001.jpg","alt":""},"title":"Video: Saraki Receives Football Legend Kanu Nwankwo, Hails His Impact on Nigerian Football","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Jan 23, 2026","dateGMT":"2026-01-23 02:02:15","modifiedDate":"2026-01-23 02:04:24","modifiedDateGMT":"2026-01-23 02:04:24","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/sports\/\" rel=\"category tag\">Sports<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/sports\/\" rel=\"category tag\">Sports<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":1,"sec":9},"status":"publish","excerpt":""},{"id":14999,"link":"https:\/\/www.kwaralefro.com\/2026\/01\/gwei-airdrop-snapshot-completed-eligibility-checker-goes-live-january-20\/","name":"gwei-airdrop-snapshot-completed-eligibility-checker-goes-live-january-20","thumbnail":{"url":"https:\/\/www.kwaralefro.com\/wp-content\/uploads\/2026\/01\/20260119_183237.jpg","alt":""},"title":"$GWEI Airdrop Snapshot Completed, Eligibility Checker Goes Live January 20","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Jan 19, 2026","dateGMT":"2026-01-19 17:46:34","modifiedDate":"2026-01-19 17:46:37","modifiedDateGMT":"2026-01-19 17:46:37","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":27},"status":"publish","excerpt":""},{"id":14996,"link":"https:\/\/www.kwaralefro.com\/2026\/01\/saraki-chief-imam-bashir-salihu-lived-a-life-of-ibadah-knowledge-service\/","name":"saraki-chief-imam-bashir-salihu-lived-a-life-of-ibadah-knowledge-service","thumbnail":{"url":"https:\/\/www.kwaralefro.com\/wp-content\/uploads\/2026\/01\/FB_IMG_1768840100404.jpg","alt":""},"title":"Saraki: Chief Imam Bashir Salihu Lived a Life of Ibadah, Knowledge, Service","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Jan 19, 2026","dateGMT":"2026-01-19 16:36:29","modifiedDate":"2026-01-19 16:36:32","modifiedDateGMT":"2026-01-19 16:36:32","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":2,"sec":43},"status":"publish","excerpt":""},{"id":14992,"link":"https:\/\/www.kwaralefro.com\/2026\/01\/forced-apc-membership-on-civil-servants-an-assault-on-democracy-kwara-pdp\/","name":"forced-apc-membership-on-civil-servants-an-assault-on-democracy-kwara-pdp","thumbnail":{"url":"https:\/\/www.kwaralefro.com\/wp-content\/uploads\/2026\/01\/IMG-20260118-WA0005.jpg","alt":""},"title":"'Forced APC Membership On Civil Servants, an Assault on Democracy' \u2013 Kwara PDP","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Jan 18, 2026","dateGMT":"2026-01-18 18:27:41","modifiedDate":"2026-01-18 18:27:44","modifiedDateGMT":"2026-01-18 18:27:44","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":2,"sec":39},"status":"publish","excerpt":""},{"id":14987,"link":"https:\/\/www.kwaralefro.com\/2025\/12\/sarakiat63-63-years-of-leadership-service-and-legacy\/","name":"sarakiat63-63-years-of-leadership-service-and-legacy","thumbnail":{"url":"https:\/\/www.kwaralefro.com\/wp-content\/uploads\/2025\/12\/WhatsApp-Image-2025-12-19-at-4.37.38-AM.jpeg","alt":""},"title":"SarakiAt63: 63 years of Leadership, Service and Legacy","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Dec 19, 2025","dateGMT":"2025-12-19 11:52:13","modifiedDate":"2025-12-19 11:52:16","modifiedDateGMT":"2025-12-19 11:52:16","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":1,"sec":35},"status":"publish","excerpt":""},{"id":14984,"link":"https:\/\/www.kwaralefro.com\/2025\/12\/crisis-in-kwara-lgs-workers-allege-governor-abdulrazaqs-illegal-politicised-dismissal-of-treasurers-dpms\/","name":"crisis-in-kwara-lgs-workers-allege-governor-abdulrazaqs-illegal-politicised-dismissal-of-treasurers-dpms","thumbnail":{"url":"https:\/\/www.kwaralefro.com\/wp-content\/uploads\/2025\/07\/Gov-Abdulrahman.jpg","alt":""},"title":"Crisis in Kwara LGs: Workers Allege Governor Abdulrazaq\u2019s \u201cIllegal, Politicised\u201d Dismissal of Treasurers, DPMs","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Dec 7, 2025","dateGMT":"2025-12-07 14:27:23","modifiedDate":"2025-12-07 14:27:29","modifiedDateGMT":"2025-12-07 14:27:29","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":2,"sec":37},"status":"publish","excerpt":""},{"id":14972,"link":"https:\/\/www.kwaralefro.com\/2025\/10\/pscfm\/","name":"pscfm","thumbnail":{"url":false,"alt":false},"title":"PSCFM","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Oct 25, 2025","dateGMT":"2025-10-25 06:22:48","modifiedDate":"2025-10-25 06:22:49","modifiedDateGMT":"2025-10-25 06:22:49","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/uncategorized\/\" rel=\"category tag\">Uncategorized<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":1},"status":"publish","excerpt":""},{"id":14965,"link":"https:\/\/www.kwaralefro.com\/2025\/10\/soso-redefining-the-way-we-do-research\/","name":"soso-redefining-the-way-we-do-research","thumbnail":{"url":false,"alt":false},"title":"Soso \u2014 Redefining the Way We Do Research","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Oct 13, 2025","dateGMT":"2025-10-13 13:08:15","modifiedDate":"2025-10-13 13:08:15","modifiedDateGMT":"2025-10-13 13:08:15","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/crypto-currencies\/\" rel=\"category tag\">Crypto Currencies<\/a>, <a href=\"https:\/\/www.kwaralefro.com\/category\/web3-crypto\/\" rel=\"category tag\">Web3\/Crypto<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/crypto-currencies\/\" rel=\"category tag\">Crypto Currencies<\/a> <a href=\"https:\/\/www.kwaralefro.com\/category\/web3-crypto\/\" rel=\"category tag\">Web3\/Crypto<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/www.kwaralefro.com\/tag\/bnb\/' rel='post_tag'>BNB<\/a><a href='https:\/\/www.kwaralefro.com\/tag\/btc\/' rel='post_tag'>BTC<\/a><a href='https:\/\/www.kwaralefro.com\/tag\/eth\/' rel='post_tag'>ETH<\/a><a href='https:\/\/www.kwaralefro.com\/tag\/hype\/' rel='post_tag'>HYPE<\/a><a href='https:\/\/www.kwaralefro.com\/tag\/soso\/' rel='post_tag'>SOSO<\/a><a href='https:\/\/www.kwaralefro.com\/tag\/sui\/' rel='post_tag'>SUI<\/a>"},"readTime":{"min":0,"sec":40},"status":"publish","excerpt":""},{"id":14956,"link":"https:\/\/www.kwaralefro.com\/2025\/10\/when-charity-begins-at-home-a-moral-reflection-for-governor-abdulrahman\/","name":"when-charity-begins-at-home-a-moral-reflection-for-governor-abdulrahman","thumbnail":{"url":"https:\/\/www.kwaralefro.com\/wp-content\/uploads\/2025\/10\/WhatsApp-Image-2025-10-11-at-18.52.58_b61754c4.jpg","alt":""},"title":"When Charity Begins at Home: A Moral Reflection for Governor Abdulrahman","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Oct 11, 2025","dateGMT":"2025-10-11 17:49:49","modifiedDate":"2025-10-11 17:54:11","modifiedDateGMT":"2025-10-11 17:54:11","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/opinion\/\" rel=\"category tag\">Opinion<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/opinion\/\" rel=\"category tag\">Opinion<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":1,"sec":29},"status":"publish","excerpt":""},{"id":14951,"link":"https:\/\/www.kwaralefro.com\/2025\/10\/kwara-pensioners-are-suffering-under-your-watch-bishop-amoo-tells-gov-abdulrazaq\/","name":"kwara-pensioners-are-suffering-under-your-watch-bishop-amoo-tells-gov-abdulrazaq","thumbnail":{"url":"https:\/\/www.kwaralefro.com\/wp-content\/uploads\/2025\/10\/WhatsApp-Image-2025-10-11-at-17.00.24_2ee43e4b.jpg","alt":""},"title":"\"Kwara Pensioners Are Suffering Under Your Watch,\u201d Bishop Amoo Tells Gov Abdulrazaq","author":{"name":"Adebayo","link":"https:\/\/www.kwaralefro.com\/author\/admin\/"},"date":"Oct 11, 2025","dateGMT":"2025-10-11 17:18:55","modifiedDate":"2025-10-11 17:18:59","modifiedDateGMT":"2025-10-11 17:18:59","commentCount":"0","commentStatus":"open","categories":{"coma":"<a href=\"https:\/\/www.kwaralefro.com\/category\/kwara-news\/\" rel=\"category tag\">Kwara News<\/a>, <a href=\"https:\/\/www.kwaralefro.com\/category\/politics\/\" rel=\"category tag\">Politics<\/a>","space":"<a href=\"https:\/\/www.kwaralefro.com\/category\/kwara-news\/\" rel=\"category tag\">Kwara News<\/a> <a href=\"https:\/\/www.kwaralefro.com\/category\/politics\/\" rel=\"category tag\">Politics<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":2,"sec":1},"status":"publish","excerpt":""}]